The Indian electric four-wheeler (E4W) market reached an all-time high in August 2025, with 17,298 units sold, according to the latest data from the Vahan Dashboard (September 1, 2025). This marks a staggering 155% year-on-year (YoY) growth compared to August 2024, when just 6,792 EV cars were registered.

The milestone also pushed EV penetration to 5% of total passenger vehicle sales, underscoring India’s rapid adoption of clean mobility.

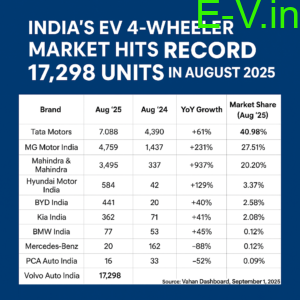

| Brand | Aug ‘25 | Aug ‘24 | YoY Growth | Market Share (Aug ‘25) |

|---|---|---|---|---|

| Tata Motors | 7,088 | 4,390 | +61% | 40.98% |

| MG Motor India | 4,759 | 1,437 | +231% | 27.51% |

| Mahindra & Mahindra | 3,495 | 337 | +937% | 20.20% |

| Hyundai Motor India | 584 | 42 | +1290% | 3.37% |

| BYD India | 447 | 227 | +97% | 2.58% |

| Kia India | 441 | 20 | +2105% | 2.54% |

| BMW India | 362 | 71 | +410% | 2.09% |

| Mercedes-Benz | 77 | 53 | +45% | 0.44% |

| PCA Auto India | 20 | 162 | -88% | 0.12% |

| Volvo Auto India | 16 | 33 | -52% | 0.09% |

Total Retail Sales (Aug 2025): 17,298 units

Key Highlights

1. Tata Motors Retains Leadership

Tata Motors continued to dominate the market with 7,088 units, accounting for 41% market share. The Nexon EV and Tiago EV remained the volume drivers, reinforcing Tata’s stronghold in the mass-market EV segment.

2. MG Motor India on a Strong Growth Path

MG Motor secured the second spot with 4,759 units and a robust 231% YoY growth. The Comet EV and ZS EV continue to perform well, supported by MG’s aggressive pricing and expanding charging ecosystem.

3. Mahindra & Mahindra’s Meteoric Rise

Mahindra clocked 3,495 units, a 937% YoY surge, securing 20% market share. The XUV400 EV has gained strong traction, positioning Mahindra as a key competitor to Tata and MG.

4. Hyundai & Kia: Korean Duo Accelerates

- Hyundai registered 584 units (+1290% YoY), led by the Ioniq 5 and Kona Electric.

- Kia surged with 441 units, marking a phenomenal +2105% YoY growth, driven by the EV6 and expanding network.

Together, the Korean brands commanded nearly 6% share.

5. Premium OEMs See Uptick

Luxury carmakers also recorded strong momentum:

- BMW sold 362 units (+410%), led by its i-series models.

- Mercedes-Benz delivered 77 units (+45%).

- Volvo saw a decline, with only 16 units (-52%).

Luxury EVs remain a niche but growing market.

6. BYD Strengthens Footprint

BYD India sold 447 units, nearly doubling sales YoY. Its Atto 3 and e6 continue to appeal to fleet operators and premium EV buyers.

7. Decline for PCA Auto (Citroën)

PCA Auto India (Citroën) struggled with just 20 units, an 88% decline YoY, suggesting weak acceptance of its eC3 in the competitive market.

Market Outlook

- EV penetration in 4-wheelers has reached 5%, up from ~2% in 2023.

- The top three players (Tata, MG, Mahindra) together accounted for 88% of the total EV car sales in August 2025, highlighting a highly consolidated market.

- Rising demand is being fueled by new launches, improving charging infrastructure, and supportive government incentives.

- With the upcoming festive season, EV car sales are expected to maintain their upward momentum into Q3 FY2025-26.

Conclusion

August 2025 stands as a landmark month for India’s electric four-wheeler market, crossing 17,000 monthly sales for the first time. With triple-digit growth across most brands, the segment is on a strong trajectory toward mainstream adoption.

As competition intensifies and more affordable EVs hit the market, India’s EV journey is accelerating faster than ever—bringing the nation closer to its 2030 electrification goals.

If you are an EV manufacturer (or) EV Dealer (or) EV Supporter who wants to share news related to Electric vehicles on our website, please send an email to crm@electricvehicles.in

For the latest Electric vehicles news,

follow electricvehicles.in on

Twitter, Instagram,Facebook

and our YouTube Channels

English, Hindi,Telugu ,

Bangla , Kannada , Tamil

Post Views:

2